Your Home Insurance, Your Choice

Home insurance solutions customized to fit your needs.

Prospective Policyholders

Current Policyholders

Why Homeowners Choose Openly

You deserve insurance that works for you, not against you. Our policies are tailored to your needs, not the other way around. Because what matters to you, matters to us.

Customizable coverage

With broad protections, our home insurance policies are designed to fit your specific needs. Openly offers guaranteed replacement cost coverage up to $5 million*, liability up to $1 million, and dozens of other unique coverage options.

*In CT, GA, KS, MS, MO, NH, OH, SC, TN and WI, coverage amount is subject to Coverage A and conditions listed in the policy.

Strong financial backing

Our carrier partners, rated A and A- (Excellent) by AM Best, ensure the timely and reliable payment of claims, providing you with peace of mind.

Seamless claims experience

When the unexpected happens, you deserve a quick and easy solution. Our hassle-free claims process and compassionate team are here to guide you with care and expertise every step of the way.

Local expertise, personalized service

Our network of local independent agents know your community inside and out and understand your unique needs and challenges.

Customizable Home Insurance Policies

Whether it's your primary home, a vacation retreat, or a property rented-to-others, we provide the protection you need.

HO-5

Primary Homes

Openly home insurance policies protect your primary home against a wide range of perils, including:

-

- Fire and smoke damage

- Wind and hail

- Water damage

- And more!

HO-5

Secondary Homes

Whether it's a mountain cabin or lakefront retreat, our secondary home insurance provides tailored protection. Safeguard your investment with coverage for:

-

- Dwelling coverage

- Liability coverage

- Personal property coverage

- Loss of use coverage

HO-3

Homes Rented-to-Others

Landlords need reliable insurance. Our rented-to-others policies are designed to cover:

-

- Property damage

- Loss of rental income

- Liability claims

- And more

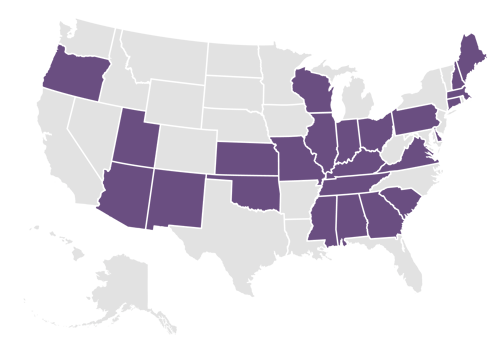

Where Openly Provides Home Insurance Coverage

Openly is currently available in 24 states and plans to expand nationwide. We’re dedicated to providing a seamless, modern home insurance experience. Explore the states where Openly offers premium home insurance through independent agents.

- Alabama

- Arizona

- Connecticut

- Delaware

- Georgia

- Illinois

- Indiana

- Kansas

- Kentucky

- Maine

- Massachusetts

- Mississippi

- Missouri

- New Hampshire

- New Mexico

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- Tennessee

- Utah

- Virginia

- Wisconsin

Claims Handled with Care

When disaster strikes, you need a partner you can trust. Openly’s claims team is here to provide you with the support and guidance you need. From initial assessment to final resolution, we work tirelessly to restore your home from back to whole.

Why Policyholders Love Openly

Don't just take our word for it–hear from satisfied customers.

We feel very safe with Openly insuring our home. I can't say that about any other insurance company, but with Openly? Absolutely, 100% safe. I know they are going to take care of us and always have our back.

Rachel E., Tennessee

Openly Policyholder

I filed a claim with Openly in March because the storm had taken off part of my roof….All the people I talked to at Openly were knowledgeable and gave me the information I needed immediately….Knowing I have Openly, I feel secure.

Marianne L., Tennessee

Openly Policyholder

Your Home Insurance Questions, Answered

How much does Openly home insurance cost?

Openly's home insurance pricing is competitive and varies based on eligibility, availability, home details, and coverage needs. Contact an independent agent to discuss your Openly options.

How fast can I get a home insurance quote?

Homeowners can now receive an instant, bindable home insurance quote in seconds by using an independent agency quoting platform. With just three key details—name, date of birth, and address—you can quickly see your coverage options and connect with an independent agent to finalize your policy.

Can I switch my current home insurance to Openly?

Yes, however, availability in your state and meeting certain requirements are necessary. Contact an independent agent to discuss your Openly options.

Do I have to work with an insurance agent?

Does Openly cover high-value homes, historic properties, or unique structures?

Openly provides home insurance for a wide range of properties, including high-value homes. While we cover many homes, those on a historic registry are presently excluded. Consult an independent agent for personalized policy information.

Resources for Homeowners

Explore more ways Openly can help protect your home, belongings, and assets through our blog. Learn about the best coverage options, typical risks homeowners face, and how Openly’s high-value policies can help you live worry-free.

-

14 min read

-

12 min read

-

8 min read